The Product Tanker Market

Analysis Creates Expertise

2019 Reflections

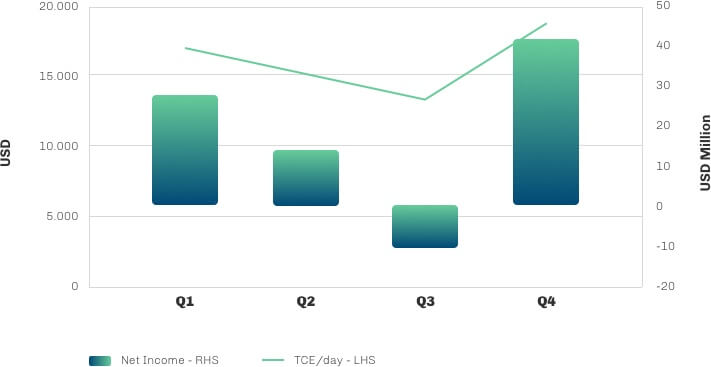

2019 started on a strong note, however throughout the first and second quarters, global refinery output declined following refinery maintenance in Europe, the US, the Middle East and Asia. Preparation for the introduction of the IMO 2020 sulphur cap, resulted in a reduction of refined product cargoes and lower demand for product tankers. According to the International Energy Agency (IEA), global refining throughput fell by 0.7 million barrels per day year-on-year in the second quarter, the largest annual decline in 10 years.

The global refining throughput declined further in the third quarter by 0.5 million barrels per day year-on-year resulting in a downward revision of IEA’s annual growth forecast to 150 thousand barrels per day, the lowest in a decade. Global oil supply fell by 1.5 million barrels per day in late Q3 2019 to 99.3 million barrels per day after attacks on Saudi oil facilities halted half of production briefly.

The product tanker market rebounded in the fourth quarter of 2019, benefiting from a rising crude tanker market brought about by US sanctions imposed on two COSCO subsidiaries, and an attack on an Iranian crude tanker in the Red Sea. Scrubber retrofits and IMO 2020 sulphur cap-related bunkering delays effectively offset tanker fleet growth in 2019 and contributed significantly to improved tanker earnings in the last quarter. The return of refineries from maintenance in the first two quarters, and high refinery runs in China, also contributed to the solid tanker earnings in the quarter.